Small businesses share concerns with recent banking closures, access to capital challenges

As recent banking closures like the Silicon Valley Bank collapse shake the financial system, Small Business Majority surveyed small business owners and decision-makers around the country to understand their concerns about banking and access to credit.

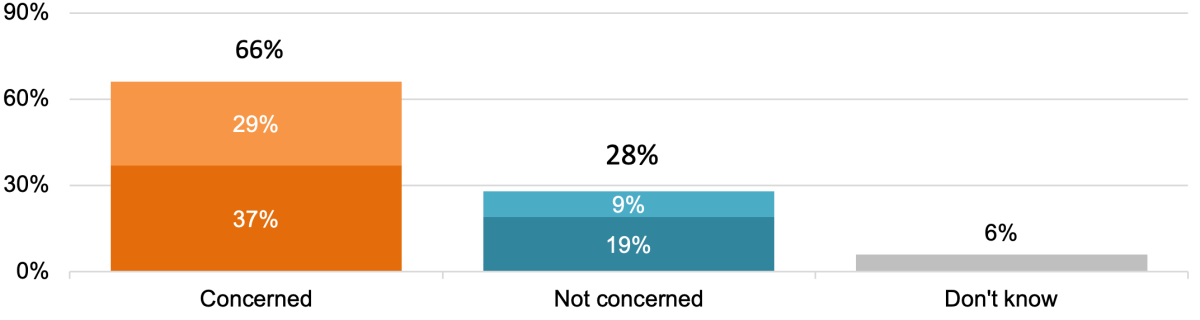

The survey found that two-thirds of small businesses are concerned about the recent bank closures. The banking closures also impact small business owners’ ability to obtain loans: more than 1 in 3 (34%) small business owners reported that their financial institution indicated they were planning to restrict lending due to the recent developments in the banking industry.

Additionally, the survey found that accessing capital has become an increasing challenge for small businesses. Fifty-five percent of small business owners found it harder to access capital in the past year, while only one in five respondents reported that accessing capital was easier. Small business owners also were affected by higher interest rates when seeking new capital or taking on more debt on existing lines of credit or on credit cards. Nearly three-fourths of small businesses felt that higher interest rates have had an impact on their ability to access capital.

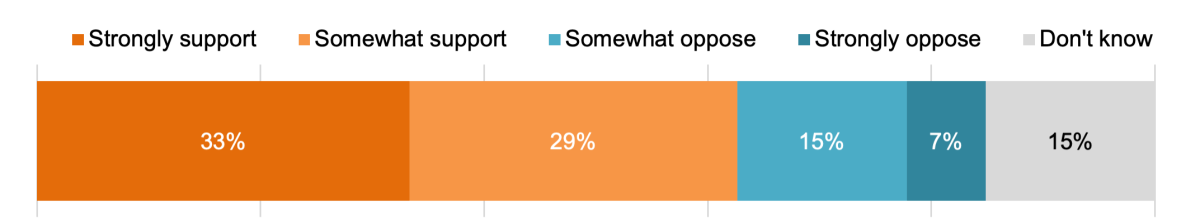

When asked about policies that could mitigate the risk caused by banking closures, respondents were in favor of greater financial protections. Sixty-two percent supported increased oversight of the financial health of our nation’s banks, including a third who strongly support such changes. Furthermore, two-thirds of small businesses support increasing the level of FDIC insurance on commercial bank deposits above the current $250,000 limit.

As these findings reveal, many small businesses are concerned about the recent banking closures and their subsequent impact on their ability to access capital. Respondents are supportive of an increased level of insurance and oversight that would provide greater financial security for their business.