Small Businesses Believe Illinois Needs to do More to Help Workers Prepare for Retirement, Support Legislation Doing So

The economy is improving, but Illinois small business owners and their employees are facing another financial hurdle: retirement security. The U.S. currently suffers from a retirement savings gap of more than $6 trillion, and more than 38 million households do not have any retirement savings at all. Illinois small business owners and their workers are no exception. A scientific opinion poll conducted for Small Business Majority by Public Policy Polling shows the majority of Illinois entrepreneurs believe most state residents are unprepared for retirement, and that the state should do more to help workers prepare for their golden years. Small business owners support the state creating legislation that will help small firms establish a basic retirement savings option for their employees.

Key Findings

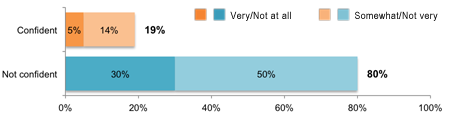

Small employers believe most Illinoisans will not have enough saved for retirement and are concerned their employees are also unprepared for the future: A vast 80% of small business owners are not confident that Illinois residents will have enough retirement savings, with 30% responding they are not confident at all. What’s more, nearly two-thirds (64%) are concerned their own employees will not have enough money saved to cover their basic living expenses during retirement. However, 75% of owners say they do have a retirement plan in place for themselves.

Small businesses believe Illinoisans will not have enough saved for retirement

How confident are you that most Illinoisans will have enough saved for retirement: very confident, somewhat confident, not very confident, or not confident at all?

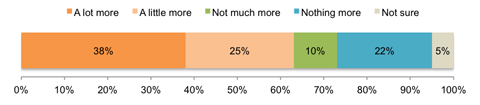

Small business owners believe Illinois should do more to encourage saving for retirement: 63% of small businesses agree Illinois should do more to help small businesses prepare for retirement, with nearly four in 10 (38%) who strongly agree.

Small employers believe Illinois should do more to help prepare residents for retirement

Do you think the state of Illinois should do a lot more, a little more, or nothing more to encourage saving for retirement?

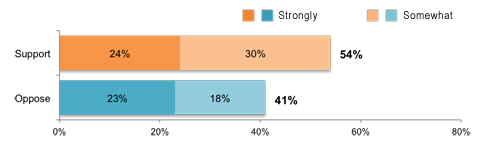

Small business owners support state legislation that would make it easier for self- employed individuals and small businesses to establish a basic retirement savings option: 54% of small business owners support proposed state legislation that would give the self- employed and small businesses with up to 25 employees the option to participate in a basic retirement account funded by employee payroll deductions, which would be managed by an investment company contracted by the state. Businesses with 25 or more employees and no workplace retirement plan would be required to offer this plan, but at no cost to the business, and employees can decline to participate. A quarter (24%) of entrepreneurs responded they strongly support this legislation.

Entrepreneurs support proposed state legislation that would make it easier for small businesses to establish a basic retirement savings option

Currently there is Illinois state legislation being considered that would give self-employed individuals and businesses with up to 25 employees the option to participate in a basic retirement account funded by employee payroll deductions and managed by an investment company contracted by the state. It is up to each person to decide if they want to contribute, and the account follows workers if they switch employers. Businesses with 25 or more employees and no workplace retirement plan will be required to offer this plan to employees, but at no cost to the business, and employees can decline to participate. Would you strongly support, somewhat support, somewhat oppose, or strongly oppose this legislation?