Small Business Owners Concerned with Predatory Lending, Support More Regulation of Alternative Lenders

Access to capital is consistently one of the most pressing issues for small business owners. Previous opinion polling from Small Business Majority found 90% of small business owners agree that the availability of small business loans is a problem. Further, according to the 2016 Small Business Credit Survey from the Federal Reserve Bank of New York, 61% of employer small businesses faced financial challenges in the last year, with credit availability or securing funds for expansion ranking as the top financial challenge. While traditional banks are still a primary source of funding for small businesses, online lending is increasingly a major source of credit, particularly for smaller firms. As online lending grows, it’s critical to understand small business owners’ opinions of alternative lending options.

A recent survey conducted by Greenberg Quinlan Rosner Research for Small Business Majority found small business owners are worried about predatory lending and agree that there should be stronger regulations on online lending. The poll was an online survey of 500 small business owners conducted between September 29 and October 4, 2017.

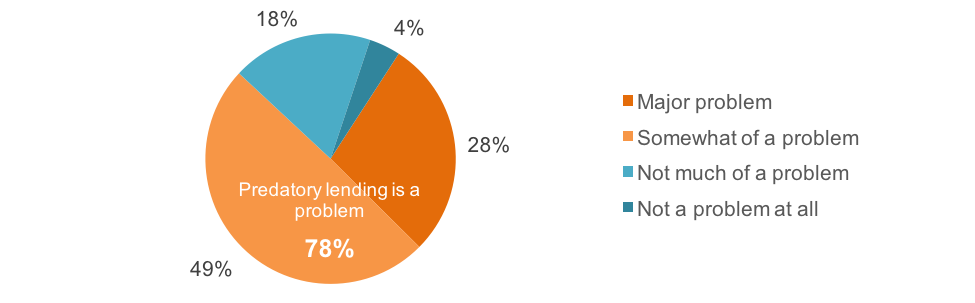

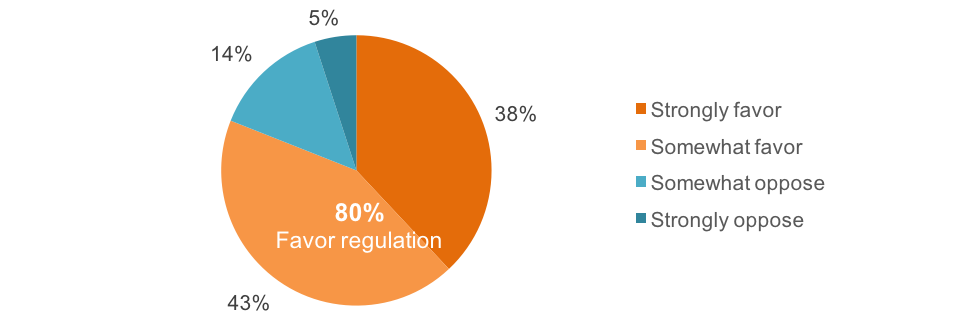

Specifically, the survey revealed that predatory lending is a particular concern for small business owners. An overwhelming majority of 74% feel that while online small business lending has opened up new sources of capital for small business owners, these lenders should be regulated to ensure small business borrows are protected from predatory practices. Nearly 3 in 10 respondents (29%) feel that these lenders need to be much more closely regulated. Additionally, an overwhelming majority of 8 in 10 small business owners reported that they are in favor of regulating online lenders to ensure interest rates and fees are clearly disclosed to borrowers. This support makes sense in light of the fact that 78% of small business owners feel that high interest, high fee products being offered to small businesses are a problem.

The poll additionally found 1 in 3 small business owners (33%) have sought capital or credit in the past 12 months. Of those small business owners who applied but did not receive a loan, nearly half (47%) reported that they were denied for having a credit score that was too low, while one-third (33%) reported their application was denied for non-credit reasons.

Key Findings

Predatory lending seen as a major problem by small business owners: A vast majority of small business owners (78%) agree that high interest, high fee products offered to small businesses are a problem. Nearly 3 in 10 (28%) think such lending is a major problem.

Small business owners agree predatory lending is a problem

Do you think that high interest, high fee products being offered to small businesses is a major problem, somewhat of a problem, not much of a problem, or not a problem at all?

Small business owners believe online lenders should be regulated: Nearly 3 in 4 small business owners (74%) feel that while small business lending has opened up new sources of capital and credit for small business owners, they should be regulated to ensure small business borrowers are protected from predatory practices. What’s more, an overwhelming majority of 8 in 10 small business owners reported that they are in favor of regulating online lenders to ensure interest rates and fees are clearly disclosed to borrowers.

Small business owners favor stronger regulation of online lenders

1 in 3 small business owners have sought capital or credit in the last 12 months: 33% of small business owners report having sought capital or credit in the last 12 months. A plurality of small business owners (47%) applying but not receiving credit report being denied because of a low credit score.

One-third of small businesses sought capital or loans in last 12 months

In the past 12 months, have you sought capital or credit from one or more of the following?