Scientific Opinion Poll: California Small Business Owners Support More Regulation of Alternative Lenders

Access to capital is consistently one of the most pressing issues for small business owners. Previous opinion polling from Small Business Majority found that 90% of small business owners agree that the availability of small business loans is a problem.[1] Further, according to the 2016 Small Business Credit Survey from the Federal Reserve Bank of New York, 61% of employer small businesses faced financial challenges in the last year, with credit availability or securing funds for expansion ranking as the top financial challenge. While traditional banks are still a primary source of funding for small businesses, online lending is increasingly a major source of credit, particularly for smaller firms. Twenty-six percent of small firms applying for credit turned to online lending, compared to 21% of large firms. As online lending grows, it’s critical to understand small business owners’ opinion of this alternative lending option.

A recent survey conducted by Greenberg Quinlan Rosner Research for Small Business Majority found small business owners are worried about predatory lending and agree that there should be stronger regulations on online lending. The poll was a national online survey of 500 small business owners with an oversample of 141 California small business owners and conducted between September 29 and October 4, 2017.

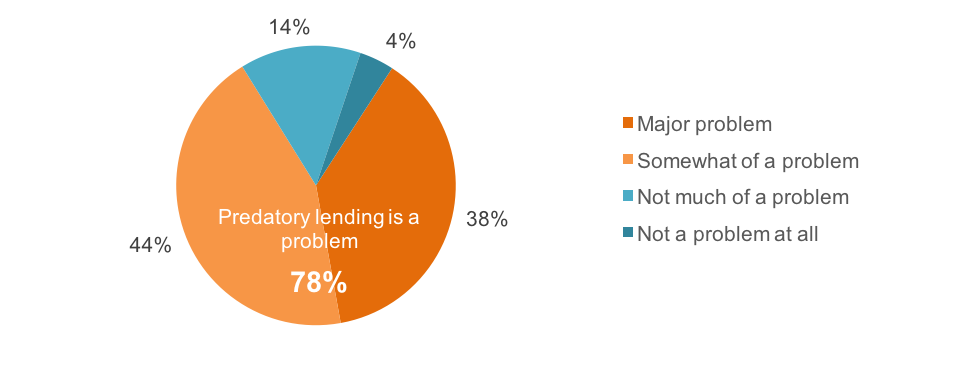

Specifically, the survey revealed that predatory lending is a particular concern for California small business owners. An overwhelming majority of 71% feel that while online small business lending has opened up new sources of capital for small business owners, these lenders should be regulated to ensure small business borrows are protected from predatory practices. Nearly 1 in 3 respondents (32%) feel that these lenders need to be much more closely regulated. Additionally, an overwhelming majority of 8 in 10 small business owners reported that they are in favor of regulating online lenders to ensure interest rates and fees are clearly disclosed to borrowers. This support makes sense in light of the fact that 82% of small business owners feel that high interest, high fee products being offered to small businesses are a problem.

The poll additionally found 4 in 10 small business owners have sought capital or credit in the past 12 months. Of those small business owners who applied but did not receive a loan, nearly half (46%) reported that they were denied for having a credit score that was too low, while more than one-third (36%) reported their application was denied for non-credit reasons. We know from the 2016 Small Business Credit Survey that, for those firms that did apply for a loan, a 55% majority sought $100,000 or less in financing.

The respondents were asked to rank factors taken into account when applying for a loan in order of importance. Small business owners reported that getting the best rate was the most important factor in applying for a loan, followed by the ease of the application and the speed of obtaining a loan.

Online lending is a fast-growing source of capital for small businesses, but small business owners feel that it’s crucial these lenders are required to operate in a safe, responsible way.