Small Business Views on Deficit Reduction, Cuts to Social Security and Medicare

Lawmakers dodged an economic bullet at the end of 2012 when they came to an 11th hour agreement on the highly publicized “fiscal cliff” issue. Not two months later, policymakers have yet another obstacle in their path that could have dire consequences for small business and the economy: what’s known in D.C. parlance as “sequestration.” The sequester is a host of automatic spending cuts set to begin March 1 because lawmakers haven’t agreed on a deal to reduce the deficit by their self-imposed deadline. As legislators work on a short-term plan that will buy time so they can focus on a comprehensive deficit reduction deal, national scientific polling makes one thing clear: small business owners strongly oppose any kind of deal that would reduce Social Security or Medicare benefits in favor of protecting unfair tax loopholes for large corporations and wealthy individuals.

Key Findings

Four in 5 small business owners agree reducing Social Security benefits would not be an acceptable way to help reduce the federal budget deficit: When presented with several policy changes that could be part of a deal to help reduce our nation’s deficit, entrepreneurs viewed Social Security benefit reductions as the least acceptable policy change: 80% believe it’s unacceptable; 50% believe it’s very unacceptable.

Four in 5 entrepreneurs agree cutting Social Security benefits is an unacceptable way to reduce our deficit

Would reducing Social Security benefits be acceptable as part of a deal to reduce the federal deficit?

Three in 4 small business owners support raising the income cap on Social Security payroll taxes, so that higher incomes start being taxed for Social Security. Two in 3 say changing the cost of living calculation—which would reduce these benefits over time—would not be acceptable. Asked about specific changes that could be made to Social Security to help reduce the deficit, entrepreneurs overwhelmingly support (72%) raising the income cap on Social Security payroll taxes, enabling the taxation of higher incomes currently not being taxed for Social Security. One-third views this as very acceptable. On the other hand, a 64% majority believes it would be unacceptable to change the way cost of living is calculated, which would reduce benefits.

Owners oppose changing the cost of living calculation, but support taxing higher income for Social Security

Here are some policy changes that might be made as part of a deal to reduce the federal budget deficit. For each one, please say if it would be very acceptable, somewhat acceptable, somewhat unacceptable, or very unacceptable to you.

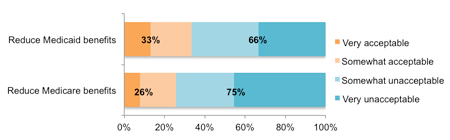

Three in 4 entrepreneurs oppose reducing Medicare benefits as part of a deficit reduction deal; 2 in 3 view reducing Medicaid benefits as unacceptable: 74% of small business owners agree making cuts to Medicare benefits to help reduce the budget deficit would be unacceptable, with nearly half (46%) agreeing it’s very unacceptable. In addition, 67% believe reducing Medicaid benefits would be unacceptable.

Strong majorities view Medicare and Medicaid benefit reductions as unacceptable

Here are some policy changes that might be made as part of a deal to reduce the federal budget deficit. For each one, please say if it would be very acceptable, somewhat acceptable, somewhat unacceptable, or very unacceptable to you.

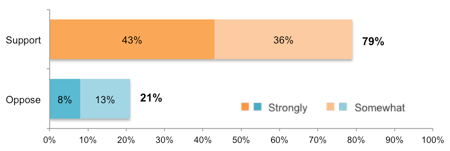

Four in 5 small employers support reforming the corporate tax code in a way that remains revenue positive by closing tax loopholes that favor large corporations, while reducing the top corporate tax rate: 79% of small business owners support reforming the corporate tax code by reducing the top corporate tax rate from 35% to 28%, while remaining revenue positive by closing corporate loopholes that put small firms at a disadvantage.

Four in 5 entrepreneurs support revenue positive corporate tax reform that eliminates loopholes favoring large corporations

Would you support or oppose a proposal that reduces the top corporate tax rate from 35% to 28% while remaining revenue positive by closing tax loopholes that favor large corporations?