Opinion Poll: Small Businesses Support Strong Accountability for Financial Industry

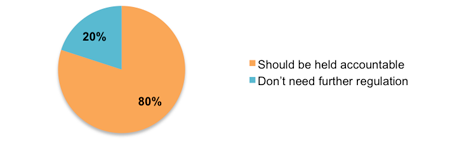

Small businesses are working hard to move their companies, and our economy, beyond the recession. As much as they’ve already accomplished to lift employment levels, these entrepreneurs are not immune to the lingering effects of our disrupted financial market, and they want smart steps taken to address their needs. Contrary to the mantra that slackening Wall Street’s reins will bring economic growth, four out of five small business owners believe Wall Street should be held accountable for the practices that caused the financial crisis, through tougher rules and enforcement. Considering the oft-politicized nature of this topic, it’s noteworthy this was a majority Republican sample.

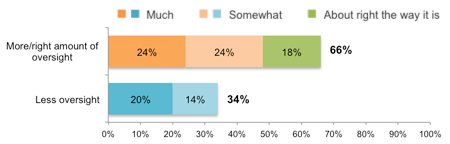

Given that such a strong majority of entrepreneurs—including 71% of Republican small business owners—believe Wall Street must be held accountable with tougher regulations, attitudes on this issue do not depend on party affiliation. It’s an issue that affects small business owners’ bottom lines, plain and simple. And that impacts their capacity to grow and hire. That’s why a two-thirds majority agrees that in general, the current degree to which government oversees financial companies—including new rules Wall Street must follow under the 2010 Dodd Frank Act—should either be strengthened, or be implemented as they are. Only one-third believes the level of regulation should decrease.

Key Findings

Four in five small business owners agree Wall Street should be held accountable for the practices that caused the financial crisis, through tougher rules and enforcement: A sweeping 80% of respondents believe rules should be strengthened to hold financial companies accountable for the practices that caused our financial collapse. On the other hand, only one in five believe these companies’ practices have changed enough that they don’t need more regulation.

Figure 1: Four in 5 entrepreneurs want Wall Street held accountable for practices that led to financial crisis

Should Wall Street financial companies be held accountable with tougher rules and enforcement for the practices that caused the financial crisis, or have their practices changed enough that they don’t need further regulation?

Two-thirds of entrepreneurs believe our level of government oversight of financial companies—including new rules under the Dodd Frank Act—should either increase or is about right the way it is; only a one-third minority believes it should decrease: A strong plurality of nearly half (48%) thinks there should be more government oversight of Wall Street banks, mortgage lenders, payday lenders and credit card companies, and another 18% think the current oversight level—which includes regulations introduced by Dodd Frank—is about right the way it is. Only one-third feels there should be less oversight.

Figure 2: Two-thirds say the degree to which government oversees Wall Street could increase or is about right; one-third minority says it should decrease

Generally speaking, do you think there should be more government oversight of financial companies, such as Wall Street banks, mortgage lenders, payday lenders, and credit card companies, less government oversight of these companies, or do you think it is about right the way it is?

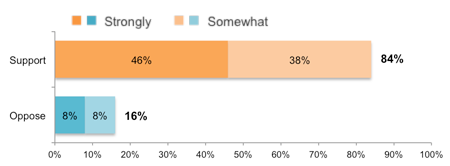

Firms overwhelmingly support the Consumer Financial Protection Bureau (CFPB), designed to protect people from abusive lending practices; and, the majority believe the CFPB is needed to ensure small businesses are treated fairly because financial companies have written their own rules for far too long: A sweeping 84% support the CFPB, a new federal agency that enforces clear rules for financial companies selling mortgages and other loans, and prevents abusive lending practices. And, 58% agree CFPB is needed because its sole mission is to prevent confusing and predatory financial practices and to ensure all financial institutions treat small businesses and consumers fairly. Only one-third says CFPB just means more bureaucracy that hurts small businesses and job creation.

Figure 3: Small businesses overwhelmingly support the Consumer Financial Protection Bureau (CFPB)

As you may know, the Consumer Financial Protection Bureau, or CFPB, is a new federal agency responsible for consumer protection, for enforcing clear rules for financial companies that sell mortgages and other loans, and for preventing abusive lending practices. In general, would you say you SUPPORT or OPPOSE the CFPB?