Small Business Views on the Fiscal Cliff and Proposals to Address it

As small business owners prepare to close the books on 2012, our country is fast approaching the edge of what’s been dubbed the “fiscal cliff.” This critical situation—created by a host of tax cuts set to expire at the end of 2012, coupled with billions of dollars in automatic spending cuts that will be triggered if Congress and the president can’t agree on a way to reduce the deficit by year’s end—has dire consequences for small businesses. Many of the tax provisions set to expire benefit small businesses and the middle class, small businesses’ core customer base. According to scientific opinion polling, the vast majority of small business owners, nearly eight in 10, are aware of this situation, and they’re concerned. Strong majorities are worried about nearly every aspect of the fiscal cliff we polled them on. As a solution, our leading job creators are looking to retain tax provisions targeting the majority of small businesses, and remove ones that benefit only a few.

Key Findings

Nearly eight in 10 small businesses are familiar with the “fiscal cliff,” tax increases and spending cuts to kick in Jan. 1 if Congress and the president don’t stop them, and entrepreneurs are concerned: A 78% majority of small business owners are somewhat or very aware that, if by the end of 2012, Congress and the president don’t figure out how to sidestep the fiscal cliff, automatic across-the-board budget cuts in discretionary spending will be triggered and a host of major tax cuts will expire. Entrepreneurs are worried about what will happen if no deal is reached.

A vast majority of entrepreneurs are familiar with the fiscal cliff

How familiar are you with this issue? Would you say you are very familiar, somewhat familiar, not very familiar or not at all familiar?

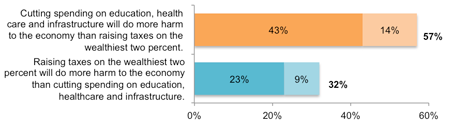

By nearly a 2:1 ratio, the majority believes spending cuts for education, healthcare and infrastructure would hurt the economy more than a tax increase on the wealthiest 2%: When asked what would do more harm to the economy—spending cuts being made to education, healthcare and infrastructure, or taxes going up on the wealthiest 2%—57% agreed the former would damage the economy more, while 32% said the latter would do more harm.

By 2:1, owners say spending cuts for education, healthcare and infrastructure will hurt economy more than raising taxes on wealthiest 2%

Please indicate which of these statements comes closer to your point of view, even if neither one is exactly right.

More than three-quarters of respondents are worried about employees facing higher payroll taxes; more than eight in 10 worry about small business expensing: A 76% majority is concerned there will be a 2% increase to payroll taxes paid by employees; more than half (51%) are very worried. Eighty-one percent are worried about the amount of qualified capital investments small businesses can expense being reduced to $25,000; 48% are very worried.

Vast majority concerned about 2% increase to employee payroll tax

Rate how concerned you are about the following tax increase or spending cut: A 2 percent increase in the employee portion of payroll taxes