Small business owners report devastating impacts of COVID-19, need immediate cash assistance to survive

It’s no secret that the spread of COVID-19 around the country has already had a devastating impact on small businesses. With the economy on pause and uncertainty gripping communities across the country, Main Street has been left to cope with how to stay afloat during this unprecedented time. While Congress allocated $350 billion in small business lending in the CARES Act stimulus package, and small businesses have been eager for these loans to get them the assistance they so desperately need, daily reports from small business owners reveal the emergency lending programs currently in place are utterly broken and will not prevent businesses from closing for good. New scientific opinion polling reveals additional insight into the dismal state of small businesses right now and what we stand to lose if Congress doesn’t act to provide the direct grant relief that small businesses overwhelmingly support.

The poll was a survey of 500 small business owners nationwide conducted by Chesapeake Beach Consulting for Small Business Majority between April 6 and 9, 2020. The survey sheds light on a shocking rate of business closures, as well as small business owners’ views on proposals that can help ensure they are able to reopen and recover once the crisis is over.

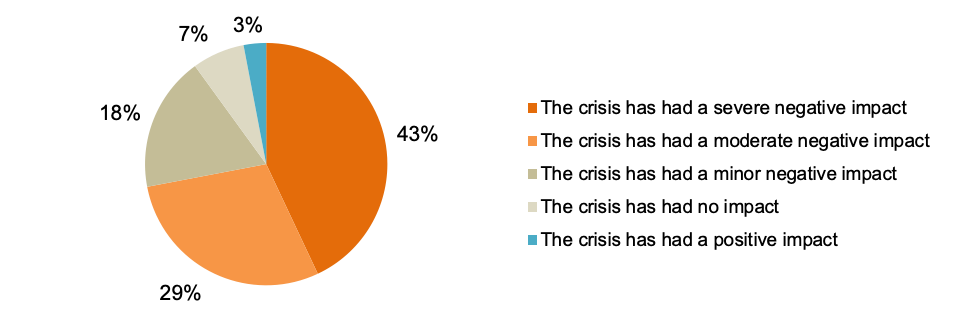

An astounding 9 in 10 say the coronavirus has impacted their business, with 43% who say it has had a severe negative impact. Similarly, 41% report their revenues have declined by more than 50% since the COVID-19 crisis has begun. And a whopping 1 in 3 small businesses have already closed.

Figure 1: Most small businesses report they’ve experienced negative impacts to their business as a result of the coronavirus crisis

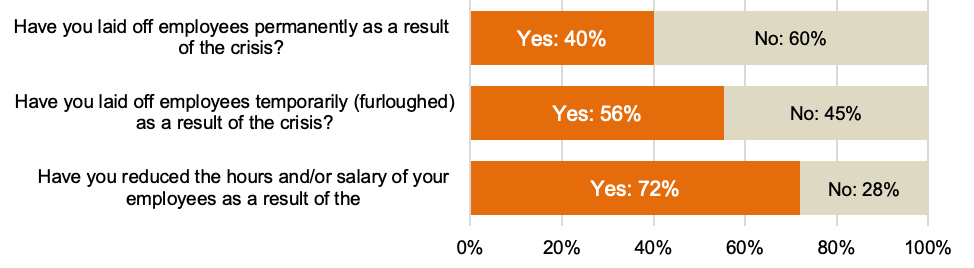

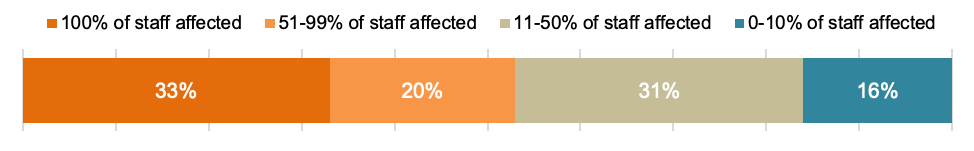

Additionally, small businesses reported widespread lay offs and furloughs. Four in 10 have permanently laid off their employees, 56% have furloughed employees and most (72%) have reduced hours, salary or both for employees as a result of the crisis. One in three have permanently laid off, furloughed or reduced the hours/salary of their entire workforce. A majority of 53% report that at least half of their workforce has been impacted by layoffs or reductions.

Figure 2a: Small businesses report widespread reductions in workforce

Figure 2b: Percentage of staff affected by temporary layoffs, reduced hours or reduced wages

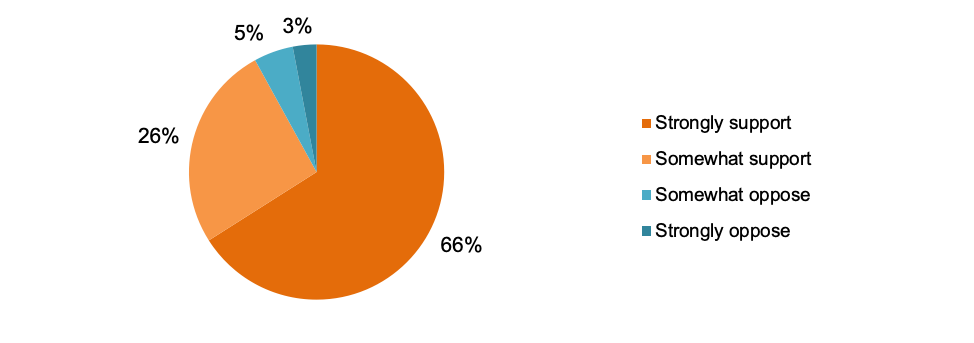

A majority (53%) of small businesses say the CARES Act, the $2 trillion stimulus package recently passed by Congress, was a good first step to address the challenges they’re facing, but they believe more small business assistance is needed. Most small businesses (92%) say what they need from the federal government to help them survive the crisis is direct grant assistance. Two-thirds (66%) strongly support direct cash grants to help ensure small businesses can recover.

Figure 3: Small businesses overwhelmingly support direct cash assistance to ensure they can recover from the crisis

Small businesses identified a number of additional solutions that would help the small business community have the relief it needs to make it through the crisis, including the following:

- Financial assistance for rent, mortgage and utility payments, not tied to maintaining payroll (86% support).

- Forbearance on all small business debt, not just current SBA loans as provided by the CARES Act (86% support).

- Increasing funding for community development financial institutions, which provide loans to small businesses (84% support).

- A moratorium on unemployment insurance taxes for two years (83% support).

As cases of COVID-19 rapidly rise throughout the country, the impacts on our small business community become even more dire each day. Millions have closed up shop, experienced dramatic losses, and are being forced to make tough decisions on their own each day about whether or not they’ll ever reopen. While the small business loan programs funded by the CARES Act may be helping a select few small businesses, our economy will not stand a chance of recovering if Congress doesn’t immediately provide direct grant assistance and other relief that small businesses desperately need while our entire society is on pause.