Small Business Owners Support Policies Promoting Access to Responsible Lending

Navigating the small business lending landscape is a longstanding, serious challenge for entrepreneurs. Traditional bank lending to small businesses has not returned to pre-recession levels, and alternative lenders that have stepped in to fill this gap do not operate under the same regulations as traditional lenders. Previous opinion polling from Small Business Majority found this lack of access to capital is a serious concern for small business owners, with 90% of small business owners agreeing that the availability of small business loans is a problem. And more recent Small Business Majority polling found 74% of small business owners feel that while online lending has opened up new sources of capital, these lenders should be regulated to ensure small businesses are protected from predatory practices. New scientific opinion polling sheds more light on small business owners’ views regarding the lending landscape, and shows that small business owners are broadly supportive of a range of policies that would support responsible lending and help them access the capital they need to launch and grow their businesses.

The survey, conducted by Chesapeake Beach Consulting for Small Business Majority, revealed that majorities of small business owners support a number of policies that could help increase the availability of traditional loans and make alternative sources of loans safer. The poll was an online survey of 500 small business owners nationwide conducted between March 5 and 11, 2018.

Specifically, the poll found more than 3 in 4 (77%) small business owners support a policy that would increase the amount of small business lending done by credit unions by lifting the cap on the amount of loans they can underwrite. Additionally, more than 6 in 10 (62%) small businesses support policies such as the Community Reinvestment Act, which requires banks to invest in low-income communities.

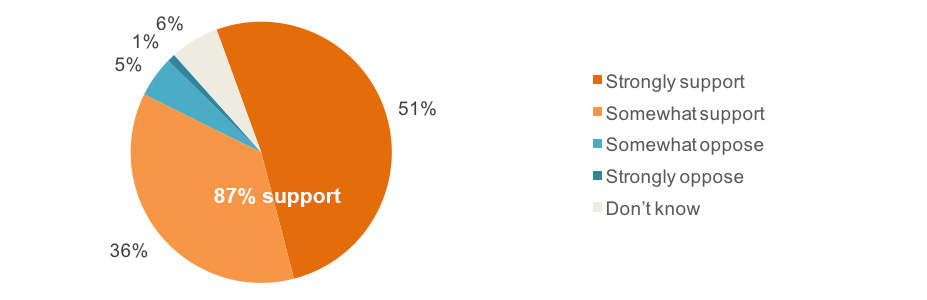

Small businesses also support policies that protect them from predatory lending practices. An overwhelming 87% of small business owners support a “truth in lending” act for small business lending to ensure loan rates and terms are disclosed transparently and consistently. Small businesses support institutions that serve to protect borrowers as well. Three in four small business owners support the Consumer Financial Protection Bureau, which oversees mortgages, credit cards and other consumer financial products in services.

Key Findings

Small business owners support policies to help increase the amount of small business lending made by credit unions: 77% of small business owners are supportive of a policy that would increase the amount of small business lending done by credit unions by lifting the cap on the amount of small business loans they can underwrite, compared to just 12% who oppose such a policy.

Small business owners support the Community Reinvestment Act: More than 6 out of 10 small business owners (62%) support policies like the Community Reinvestment Act, a federal law that requires that banks make investments in low-income communities.

Small business owners overwhelmingly support a “truth in lending” act that would increase transparency: A decisive majority of 87% of small business owners support a “truth in lending” act for small business lending to ensure loan rates and terms are disclosed transparently and consistently. A 51% majority of small business owners strongly support such legislation.

Small businesses support institutions that protect consumers: 3 in 4 small business owners support the Consumer Financial Protection Bureau, which oversees mortgages, credit cards and other consumer financial products and services. One in three small businesses strongly support this institution, compared to just 15% who are opposed.